Industry: Consumer, Education & Social Impact, Financial Services, Healthcare & Life Sciences, Industrial, Legal, Media, Entertainment & Communications, Services, Technology

Role: Finance & Accounting

The path to the CFO seat varies by company size and industry, but three additional background experiences predict success for the role in private equity environments.

What’s the most common path to CFO in Healthcare versus Technology? How does company size impact which backgrounds companies should prioritize when hiring a finance leader? We explored these questions in our 2025 Compensation & Insights Study of 312 sitting CFOs, 83% from PE/VC-backed companies.

When we analyzed respondents’ most recent pre-CFO roles, clear patterns emerged: today’s finance leaders rise primarily from traditional finance functions, with fascinating variations by industry and company size.

But common career paths don’t tell us everything about who excels in the role. JM Search partners Felix Korostin and John Foristall have identified three key differentiators that transform solid finance professionals into exceptional PE CFOs, regardless of whether they come from FP&A, Controller, Investment Banking, or Corporate Development.

“How would you define your financial background prior to becoming CFO?”

Industry Requirements Lead to Varied CFO Backgrounds

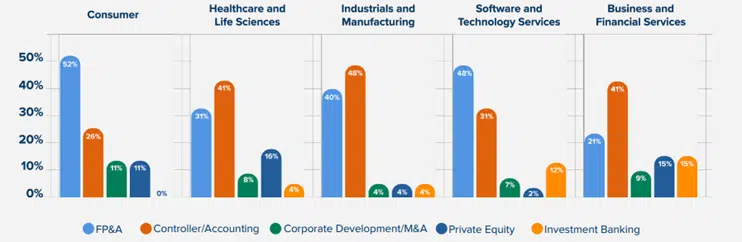

Regardless of industry, it’s clear that CFOs most commonly come from traditional financial backgrounds like FP&A and Controller/Accounting. However, different sectors show clear preferences based on their operational needs:

- Consumer & Technology sectors: FP&A backgrounds are most common (52% and 48%) – these sectors require strategic thinkers who can model scenarios and drive pricing decisions

- Healthcare & Industrials sectors: Controller backgrounds dominate (41% and 48%) – where technical precision in cost accounting and compliance matters most

As John Foristall, Partner at JM Search, explains: “Consumer businesses tend to focus heavily on pricing, margins, customer acquisition costs, and other analytics; that’s more of an FP&A skill set. Manufacturing and healthcare businesses on the other hand often involve complex cost accounting and inventory valuation considerations. These environments require deep technical accounting expertise.”

Company Size Adds Critical Nuance

Company size reveals distinct patterns in CFO backgrounds. Controllers represent the most common prior role at both ends of the spectrum: 40% in companies under $49M and 41% in companies over $500M. The mid-market, however, shows notably different patterns.

Lower Mid-Market ($100M-$249M):

- Corporate Development/M&A: 32%

- Investment Banking: 25%

- Controller/Accounting: 25%

- FP&A: 22%

- Private Equity: 21%

Upper Mid-Market ($250M-$499M):

- Investment Banking: 25%

- Corporate Development/M&A: 16%

- FP&A: 16%

- Controller/Accounting: 15%

- Private Equity: 10%

This diversity likely reflects the unique challenges mid-market companies face. Unlike smaller companies focused on building core operations or larger companies optimizing established processes, mid-market organizations often juggle multiple priorities: strengthening infrastructure, pursuing acquisitions, and preparing for potential exits. These varied demands may explain why CFOs with deal experience become more prevalent in this segment, though traditional finance backgrounds remain well-represented.

The Three Differentiators of PE CFO Excellence

Beyond these foundational backgrounds, our search partners identified three experiences that truly predict PE success:

1. Prior PE Experience: Your Best Insurance Policy

“Having previous private equity experience has become increasingly important. For most of our searches, it’s a key requirement.” – Felix Korostin, Partner at JM Search

This preference isn’t arbitrary. Those with PE experience on their resume bring capabilities that directly address the unique demands of the role:

-

- Accelerated Decision-Making: Operating with urgency in compressed 2 to 5 year value creation windows while maintaining precision

- Strategic Partnership: Moving beyond reporting to quantifying decisions and driving returns through financial planning, operational improvements, and data insights

- Exit-Focused Execution: Making every strategic decision with the end goal (exit) in mind

Those with PE experience also possess a unique ability to adapt to their environments and priorities, which Foristall explains is a key attribute:

“Great CFOs can adapt to a variety of ownership structures, but in private equity, the critical question is: where is the business from a maturity standpoint and what is the business driving towards? Is the primary focus on top-line growth and market share? Is it profitability? Is it cash flow? Obviously, all of these metrics drive value creation, but which of those metrics is king at that time can really vary.” – John Foristall

2. Cross-Functional Leadership

“Today’s CFOs spend as much time outside of their finance team as within it,” Korostin notes. “Our clients look for CFOs who are cross-functionally collaborative and excel at quantifying decisions across all business functions, bringing financial rigor to operational, sales, and strategic decisions.”

Our research validates that this is an increasingly important aspect of the CFO role, with those we surveyed weighing in on other areas of the business they oversee:

-

- In the lower/mid-market segment, which includes companies with revenues between $100M and $249M, CFOs commonly oversee Legal & Compliance (47%) and HR (26%). Eleven percent oversee Operations.

- Similarly, in upper/mid-market companies with revenues between $250M and $499M, 42% of CFOs manage Legal & Compliance, 28% oversee HR, and 8% have operational responsibilities.

Foristall notes that this breadth builds the trust and business acumen needed to be seen as a true strategic partner. “Today’s CFOs must be plugged into all facets of the business. They must build rapport with all stakeholders, and when they’re doing it right, they’ll be welcomed into the room as they can add real value, drive better decisions, and help others win.”

We’ll explore in detail additional findings around the expanded scope of the CFO role in our next blog on CFO responsibilities and value creation priorities.

3. Real-Time Decision Making: From Record Keepers to Strategic Advisors

“Strong CFOs are signal callers on the field,” Foristall emphasizes. “They read and react in real time.”

If your CFO is waiting for month-end to tell you what happened, you’re already losing. Modern PE CFOs must provide actionable insights as events unfold, not historical reports.

Foristall added: “The best candidates have proven throughout their careers that they’re both strategically and operationally oriented, capable of quantifying business decisions in real time rather than waiting for month-end reports to tell the story.”

This requires proven experience with:

-

- Dynamic forecasting models that update with business changes

- Data analytics and visualization tools for real-time insights

- The ability to make data-driven recommendations during meetings, not days later

The Bottom Line

Your industry and company size shape which finance path typically leads to the CFO seat. But in private equity’s compressed timeframes, prior role is just the starting point. What truly predicts success are three experiences that transcend any single title: PE exposure, cross-functional leadership, and the ability to lead real-time decision making. Make these your non-negotiables, and you’ll find a CFO who can help achieve target returns.

Data from JM Search’s 2025 CFO Compensation & Insights Study, surveying 312 sitting CFOs across PE/VC-backed and private companies. Stay tuned for our next blog exploring the expanded scope of the CFO role and value creation priorities.

Insights in your inbox

Stay up to date on the latest trends and insights shaping the executive search landscape from JM Search’s Blog.