Industry: Consumer, Education & Social Impact, Financial Services, Healthcare & Life Sciences, Industrial, Legal, Media, Entertainment & Communications, Services, Technology

Role: Finance & Accounting

Organization: Private Equity

Once the steward of balance sheets and compliance, today’s PE CFO has become the architect of growth, operational excellence, and strategic transformation. Our 2025 Compensation & Insights Study of 312 CFOs – 83% from PE/VC-backed companies – reveals how the role has expanded and what separates successful hires from those who struggle to deliver.

The Expansion of the Private Equity CFO

In our previous blog, The PE CFO Formula: Traditional Paths Meet Modern Differentiators, we broke down the most common paths to the CFO role, and the differentiators that set them apart in PE. Here we turn our focus to what happens when the CFO is in the seat – and why the role has fundamentally transformed.

What was once a finance-focused role has become a value creation engine, driven by four key market forces:

- M&A-centric value creation: As PE growth strategies increasingly center on acquisitions and complex transactions, firms are prioritizing CFOs who can execute deals and integrate acquisitions rather than simply manage financial reporting. This shift has driven demand for candidates with investment banking or PE backgrounds rather than purely accounting-focused profiles.

- Extended hold periods: With exit timelines stretching longer, CFOs need to sustain performance over extended horizons while maintaining exit readiness, demanding both operational excellence and strategic vision.

- Operational efficiency demands: Leaner finance teams, especially in middle market companies, require CFOs to expand their scope beyond financial reporting to drive growth initiatives and operational improvements directly.

- Economic climate: High interest rates and tighter credit markets have amplified the importance of cash management, debt optimization, and banking relationships, elevating CFOs to a more strategic role in preserving deal returns.

Our 2025 survey data highlights this shift in CFO scope:

- In lower mid-market companies ($100M–$249M), 47% of surveyed CFOs oversee legal and compliance, 26% oversee HR, and 11% oversee operations.

- In upper mid-market companies ($250M–$499M), 42% of surveyed CFOs oversee legal and compliance, 28% oversee HR, and 8% oversee operations.

This expansion of scope is even more pronounced in companies under $100M, where CFOs frequently step into multiple non-finance functions.

“CFO functional oversight by company size”

“In smaller and mid-market companies, we routinely see the CFO filling operational gaps,” notes JM Search Principal Lisa Phillipi. “Beyond managing the numbers, today’s CFOs are expected to wear multiple hats – building teams, leading transformation, and quarterbacking the entire enterprise.”

In industries like healthcare, Phillipi notes, we’re seeing CFOs double as COOs – or even transition into CEO or President roles.

The New Non-Negotiables for Private Equity CFOs

The expanded CFO role has raised the bar for what distinguishes a good finance leader from a great one. In our daily work supporting high-growth companies with CFO searches, we see three themes consistently emerge as the top priorities for clients evaluating their next CFO:

1. Strategic Partner and “Adult in the Room”

A client recently told us they were looking for a CFO who could be “the adult in the room” – a leader who challenges the CEO, founders, and boards when appropriate and isn’t afraid to question the status quo when necessary. These types of CFOs excel at:

- Executive influence and analytical leadership: They gain respect across the C-suite and boardroom by delivering objective, data-driven insights that cut through emotional decision-making and help leaders see past their blind spots.

- PE relationship management: They serve as the trusted bridge between management teams and PE sponsors, ensuring both sides stay aligned on performance expectations and value creation priorities.

- CEO partnership and strategic guidance: They support ambitious growth plans while providing experienced counsel on risk management and execution, which is particularly valuable when the CFO brings more institutional experience than a first-time CEO.

2. Transaction Readiness & Experience

The strongest PE CFOs today also help keep companies exit-ready while building scalable operations for long-term value creation. They do this by professionalizing finance functions, managing debt and banking relationships, and leading M&A through integration and eventual exit.

“PE firms are doubling down on CFOs who can deliver transformation and successful transactions. They want someone who’s seen it and done it before,” says Philippi.

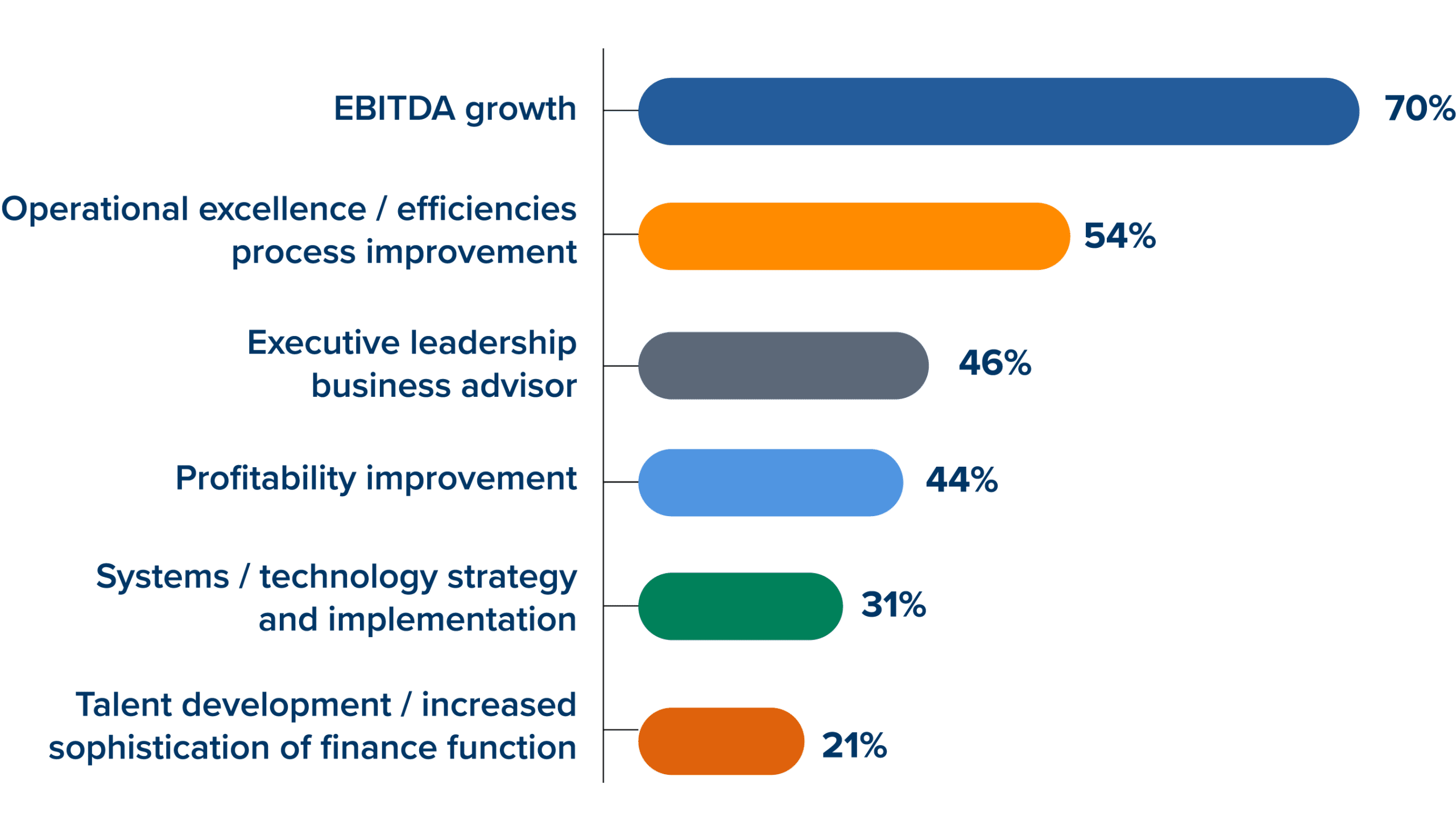

This focus on professionalization is a significant value creation opportunity that many of today’s CFOs may be underutilizing. While EBITDA growth remains the primary driver of PE returns, only 21% of CFOs in our recent study cited finance function sophistication as a growth driver.

“CFOs who invest in building strong teams, implementing scalable systems, and embedding operational rigor unlock critical value,” says JM Search Partner David Robinson. “This isn’t just about transaction readiness; it’s about creating sustainable competitive advantages.”

“In your role, which areas contribute most to value creation for the business? (Select up to 3)”

3. Cross Functional Leadership

Today’s PE CFOs must do more than oversee multiple functions. What sets the best leaders apart is their ability to knit those functions together into a cohesive force for transformation.

“The strongest CFOs are skilled at unifying strategy, people, and execution across the organization,” Robinson notes. “That’s what enables them to drive transformation, not just manage complexity.”

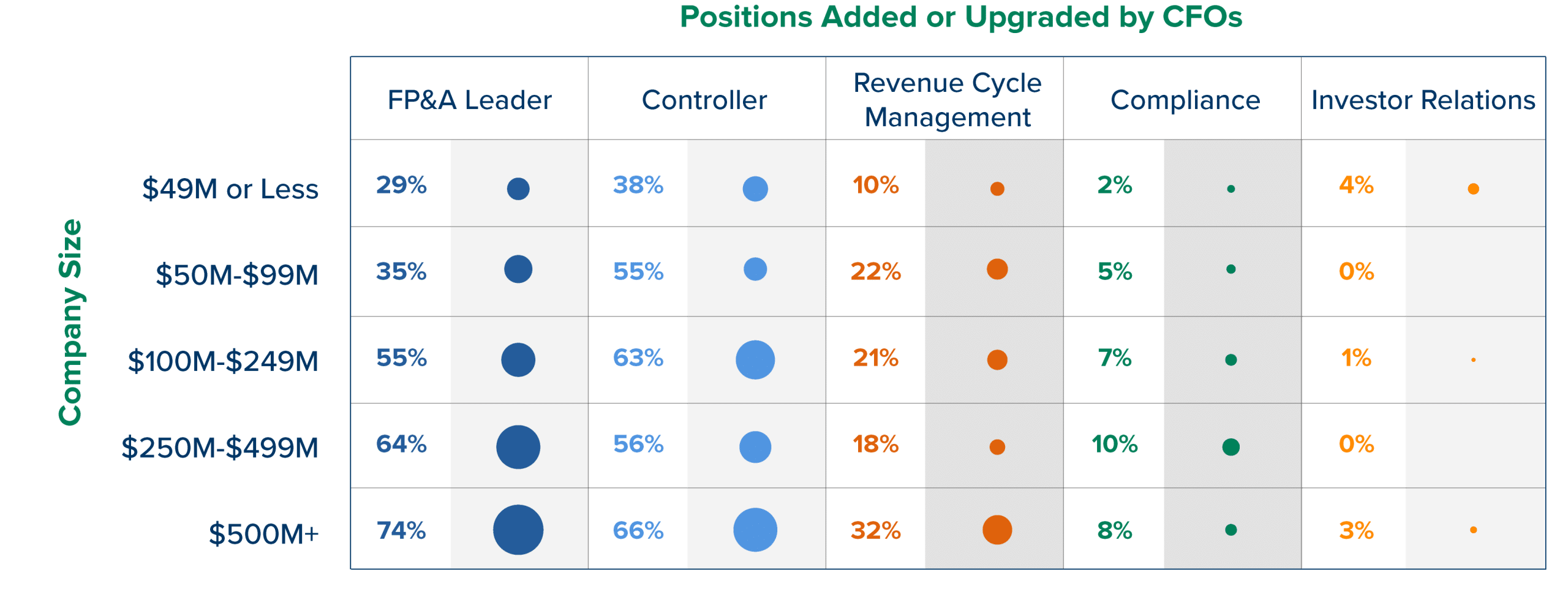

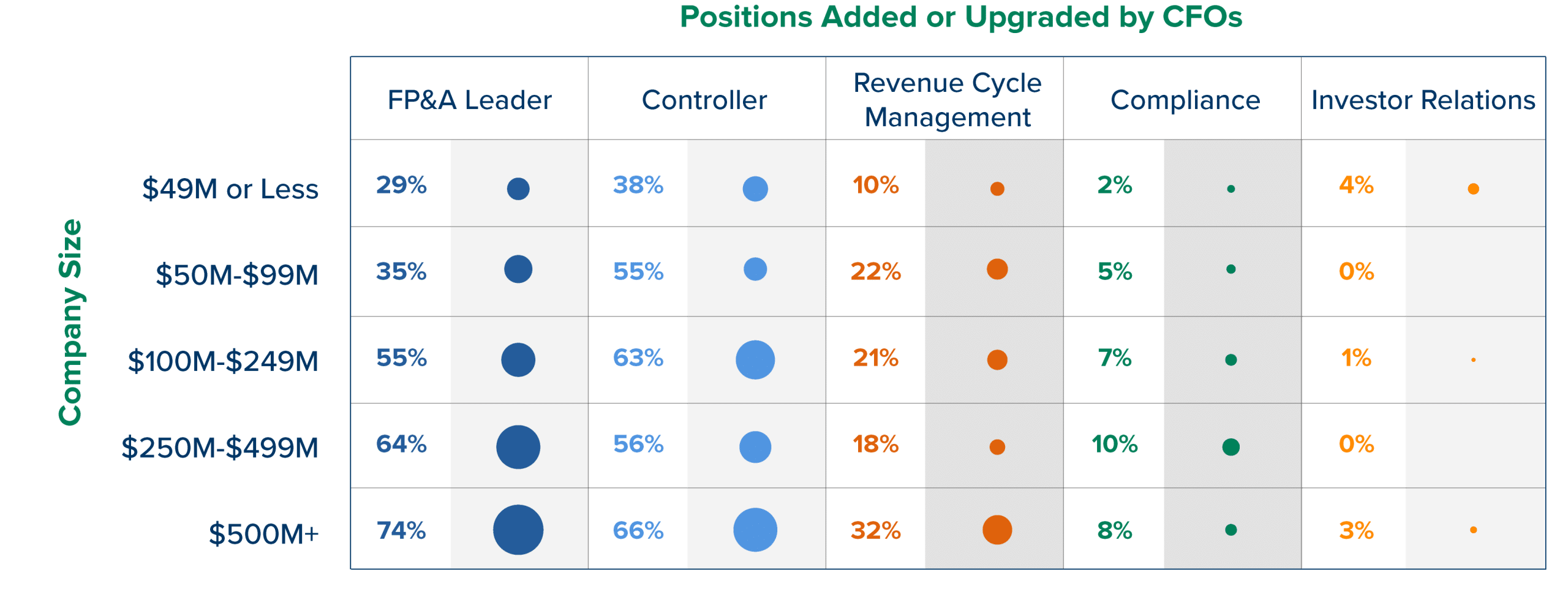

Building the right team is critical to this success. Across company sizes, our research shows controllers and FP&A leaders consistently emerge as a CFO’s most indispensable partners. Compliance and investor relations, while important, play a secondary role.

As Philippi shares, “This reflects a broader shift: finance teams are being designed less for transactional processing and more for strategic insight, execution support, and scalable growth.”

“Have you added or upgraded any of the following positions since starting at your role? (Select all that apply”

The Bottom Line: The CFO as Growth Architect

For PE firms, success now hinges on recruiting finance leaders who can influence the boardroom, drive transactions, unify teams, and embrace technology. The top finance leader isn’t just preserving value, they’re creating it.

Explore our 2025 CFO Compensation & Insights Study for the full data behind these trends, and learn more here about how JM Search partners with PE firms and CEOs to recruit the financial leaders who drive lasting value.

Insights in your inbox

Stay up to date on the latest trends and insights shaping the executive search landscape from JM Search’s Blog.